cyber hygiene mas

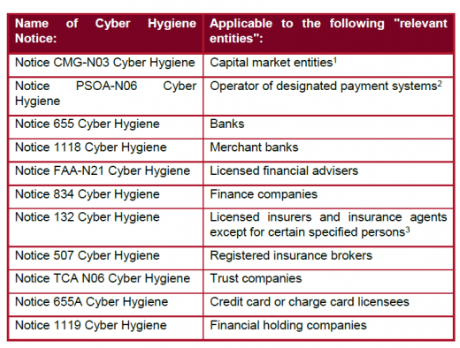

On 6th August 2019 The Monetary Authority of Singapore MAS issued a set of legally binding requirements to raise the cybersecurity standards and strengthen cyber resilience of the financial sector. With the Notice coming into effect on 6th August 2020 PwC has a quick health check for you to assess your readiness to comply with the Notice.

Cyber Hygiene Rules Singapore To Kick In August 2020 Mas

The measures will come into effect on August 06 2020.

. Securities and Futures Act Cap. 2 The revised Guidelines focus on addressing technology and cyber risks in an environment of growing use by financial. The announcement of the rules which will kick in exactly a year from now comes after MAS consulted the industry over.

The Monetary Authority of Singapore MAS today issued revised Technology Risk Management Guidelines 5787 KB Guidelines to keep pace with emerging technologies and shifts in the cyber threat landscape. Notice 132 Cyber Hygiene. Proven and most cost-effective package in the market.

Implement adequate administrative account access policies. All financial institutions and e-payment firms in Singapore must comply or risk facing sanctions. Iii such persons or class of persons as may.

These recently issued cyber hygiene measures. Requirements on cyber hygiene for insurers and insurance agents. Cyber Hygiene services are provided by CISAs highly trained information security experts equipped with top of the line tools.

Complying with Monetary Authority of Singapore MAS Cyber Hygiene guidelines. Takes effect from 6 August 2020. A relevant entity must secure every administrative account on its system to prevent any.

Monetary Authority of Singapore MAS released a Notice on Cyber Hygiene on 6 th August 2019 to raise cyber security standards and strengthen cyber resilience of financial institutions in Singapore. The notice on cyber hygiene sets out the measure financial institutions must take to mitigate the growing risk of cyber threats by 6h August 2020. B all insurance agents except for any of the following persons.

Ii a person exempted from holding a financial advisers licence under section 23 1 f of the Financial Advisers Act Cap. Apply security patches and relevant security controls in a timely manner to address vulnerabilities. 186 the Act and applies to all financial holding companies relevant entity approved under section 28 of the Act.

MAS also published the frequently asked questions FAQs on these measures. Comply to Monetary Authority of Singapore MAS Cyber Hygiene starting from 8100. The workbook covers each of the six categories of cyber hygiene in Notice 655 and maps to the following.

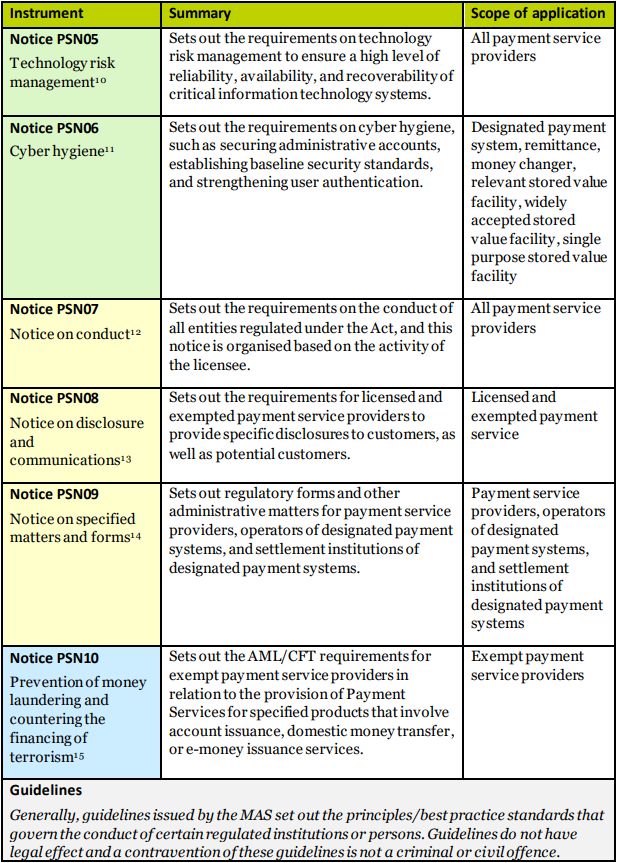

Notice issued under the Payment Services Act 2019 that set out cyber hygiene requirements. Summary of the MAS Cyber Hygiene Notice. Notice PSN06 Cyber Hygiene.

The Notice on Cyber Hygiene Notice sets out the measures that financial institutions FIs must take to mitigate the growing risk of cyber threats and will come into effect on 6 August 2020. The Notice on Cyber Hygiene makes key elements in the MAS Technology Risk. The Notice makes key requirements in the existing MAS Technology Risk Management Guidelines legally binding.

In light of these events the Monetary Authority of Singapore MAS has introduced today 6 August the new cyber hygiene rules. In response to a spate of data breaches globally the Monetary Authority of Singapore MAS has stepped up efforts to strengthen the sectors defence against rising threats announcing that all financial services and e-payment firms in Singapore must comply with a new set cyber hygiene rules. AWS is responsible for the security of the cloud but you are responsible for your security in the cloud.

To this end MAS issued a set of legally binding requirements to raise the cyber security standards and strengthen cyber resilience of the financial sector in Singapore. Cyber Hygiene Practices 41 Administrative Accounts. Requirements on cyber hygiene for capital market entities.

Notice CMG-N03 Cyber Hygiene. 42 Security Patches. Singapore 18 January 2021.

On 6 August 2019 the Monetary Authority of Singapore MAS issued a set of legally binding requirements to raise the cyber security standards and strengthen cyber resilience of the financial sector. So the proposed MAS cyber hygiene notice lays out 6 cyber security requirements. Any bank This Notice is issued pursuant to section 551 of.

The financial sector needs to remain vigilant and ensure that defences are able to counter varied and evolving threats. Tan Yeow Seng in reference to the Notice on Cyber Hygiene Cyber threats in the financial sector are growing as a result of an increased digital footprint and pervasive use of the Internet. In the Monetary Authority of Singapore MASs most recent revision to the Technology Risk Management Guidelines in 2021 the updated guidelines focus on addressing technology and cyber risks by financial institutions FIs specifically in cloud technologies application.

A relevant entity must ensure that every administrative account in respect of any operating system database application security appliance or network device is secured to prevent any unauthorised access to or use of such account. 289 section 45 1 section 46ZK 1 section 81R 1 section 81SV 1 section 81ZL 1 section 101 1 section 123ZZB 1 and section 293 1. Any financial holding company This Notice is issued pursuant to section 283 of the Monetary Authority of Singapore Act Cap.

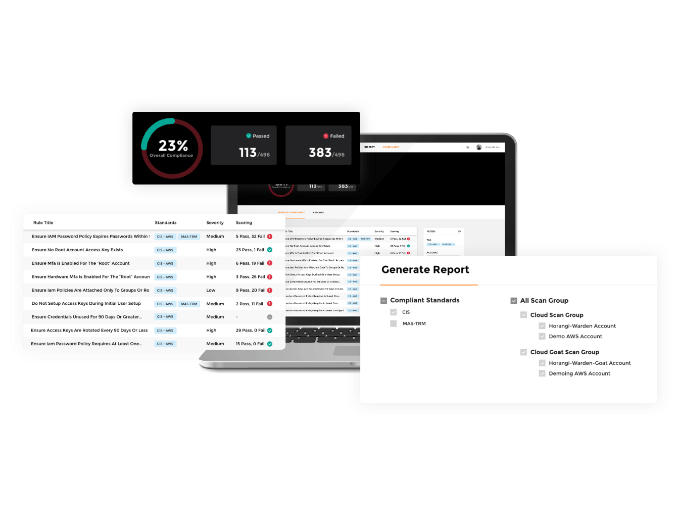

This notice applies to the following capital. The Monetary Authority of Singapore MAS today issued a set of legally binding requirements to raise the cyber security standards and strengthen cyber resilience of the financial sector. MAS Cyber Hygiene Compliance Package Comply to Monetary Authority of Singapore MAS Cyber Hygiene from 8100 today.

Our mission is to measurably reduce cybersecurity risks to the Nation by providing services to government and critical infrastructure stakeholders. On 6th August 2019 the Monetary Authority of Singapore MAS released a Notice on Cyber Hygiene to raise the cyber security standards and strengthen cyber resilience of the financial sector. The Notice on Cyber Hygiene sets out the measures that financial institutions must take to mitigate the growing risk of cyber threats.

It sets out cyber security requirements on securing administrative accounts applying security patching establishing baseline security standards deploying network security devices implementing anti-malware measures and. The legally binding Notice on Cyber Hygiene came into effect on 6. To aid in your alignment to Notice 655 AWS has developed a MAS Notice 655 Cyber Hygiene Workbook which is available in AWS Artifact.

The Notice on Cyber Hygiene sets out the measures that financial institutions must take to mitigate the growing risk of cyber threats. In the words of the Chief Cyber Security Office of MAS Mr.

Off To The Races The Commencement Of The Payment Services Act Financial Services Singapore

Singapore Monetary Authority Of Singapore Issues New Rules To Strengthen Cyber Resilience Of Financial Industry Lexology

Singapore Mas Compliance And Application Security Immuniweb

Technology Risk Management Guidelines Notice On Cyber Hygiene For Singapore S Ibm I Community Jouletech

Cyber Hygiene Assessment Deloitte Singapore

Singapore Monetary Authority Of Singapore Issues New Rules To Strengthen Cyber Resilience Of Financial Industry

Cyber Hygiene And Mas Notice 655 Aws Security Blog

Mas Cyber Hygiene Compliance With Horangi

Mas Cyber Hygiene Compliance With Horangi

Meeting Mas Cyber Hygiene Notice Requirements On Aws Youtube

Mas Cyber Hygiene Compliance With Horangi

Cyber Hygiene Covering All Bases Privasec Global

Mas Cyber Hygiene Compliance With Horangi

Complying With Monetary Authority Of Singapore Mas Cyber Hygiene Guidelines Whitepaper Tenable

Mas Cyber Hygiene Compliance With Horangi

0 Response to "cyber hygiene mas"

Post a Comment